Year-over-year median home-sales prices had increased for 86 consecutive months across the Mid-Atlantic housing market. But a flat April brought that streak to a close.

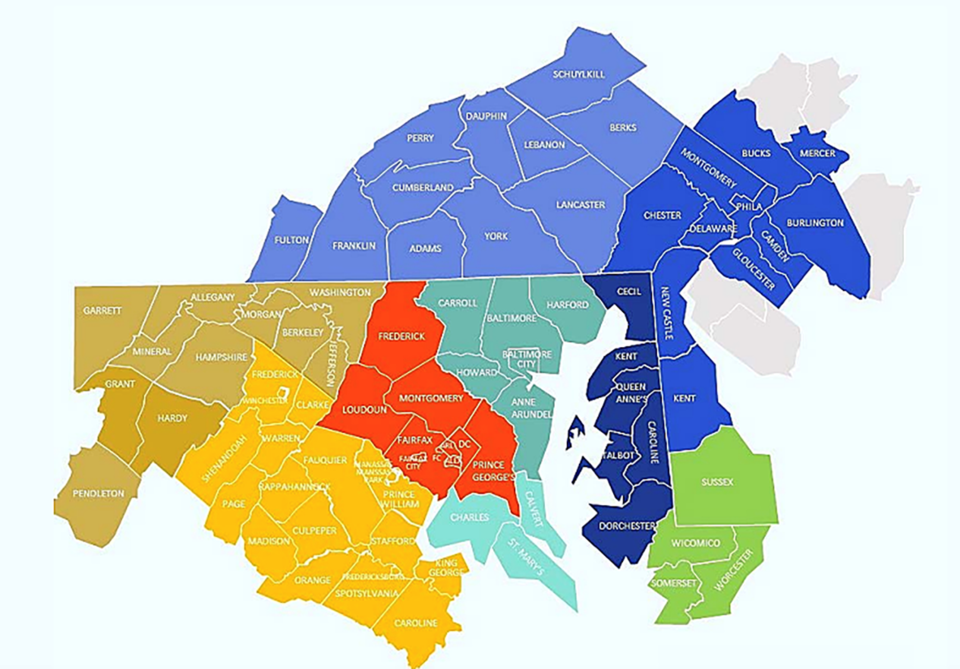

“The Mid-Atlantic housing market has not warmed up like it would have during a more typical spring,” acknowledged Lisa Sturtevant, chief economist for Bright MLS, which manages multiple-listing services covering about 70 localities across the District of Columbia, Delaware, Maryland and portions of Virginia, West Virginia, Pennsylvania and New Jersey.

“The effect of the relatively high mortgage rates and uncertainty in the economy are definitely having an impact,” Sturtevant said.

At the same time, given the lack of inventory across the region, “homes are still selling very quickly, and there is a lot of competition for relatively few homes for sale,” Sturtevant said.

The median home-sale price across the Bright MLS region in April was $380,974, a slight decline from a year ago. Most of that decline was concentrated in the Washington metropolitan area; most other regions saw increases – and prices remain 30-percent higher than pre-pandemic levels.

A total of 17,341 sales closed during the month across the region, down 29 percent from a year before. Buyers are out and about, but the light inventory means they have less to choose from.

Pending sales rose 4.1 percent from March to April, significantly slower than the typical month-over-month jump as the market kicks into springtime.

The 22,365 pending sales in April reflect an overall “subdued” spring housing market but there was a higher increase (8%) in the sales of single-family homes. Townhouses and condominiums saw lower month-over-month sales.

The outlook for later in the year? “Many discretionary sellers have been sitting on the sidelines as many homeowners have locked in extremely low mortgage rates and they are not enticed to move and take on a higher rate,” Sturtevant noted. “As we head through the rest of the year, more homeowners will be looking to sell and inventory should improve somewhat. However, inventory will continue to be limited and the market will still favor sellers.”

Figures represent most, but not all, homes on the market. All April 2023 figures are preliminary and are subject to revision.